member information and resources | debit card review

08.19.2024

member update | debit card review

At Service 1st Federal Credit Union, keeping you informed and keeping your information safe is a top priority.

As we shared last week, we recently discovered suspicious activity which could indicate unauthorized access to certain debit card details.

We also identified that this activity was related to a skimmer scam.

We are continuing to work with our security experts and following protocol. As we move into the next stage, out of an abundance of caution, we are issuing new debit cards to anyone who may have been affected. These members will be receiving notices by mail later this week.

We are also happy to report that no Personal Identifiable Information (PII) was compromised as part of this incident.

Please watch your mail, email and this page for updates.

Thank you for your understanding and continued membership with Service 1st.

Sincerely,

Your friends from Service 1st

08.13.2024

member update | debit card review

At Service 1st Federal Credit Union, keeping you informed and keeping your information safe is a top priority.

As we shared yesterday, we recently discovered suspicious activity which could indicate unauthorized access to certain debit card details. We are actively investigating the situation, following proper protocol and working closely with security experts to ensure your information remains protected.

As part of our investigation, we are learning that this item is tied to a skimmer scam.

As we confirm more information, we’ll continue to update you. In the meantime, below is some information related to skimmers and some tips to help you stay alert.

Skimmers | Stay Alert

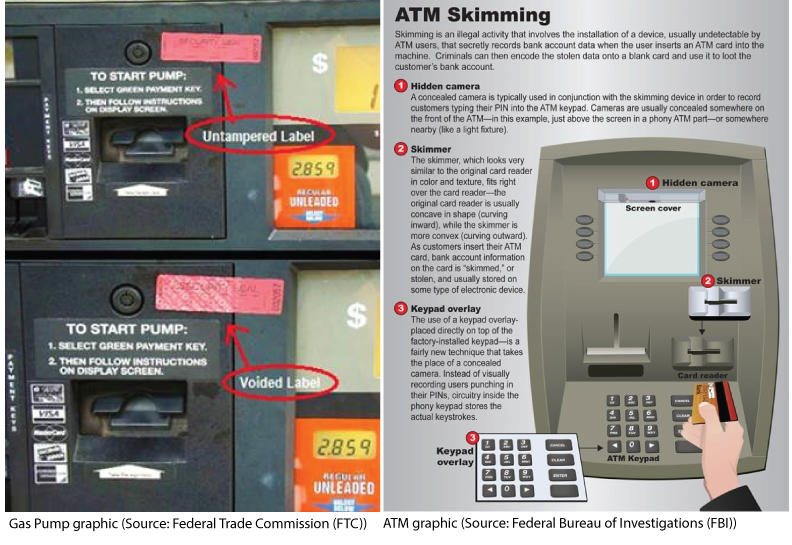

The craftiness of evil doers never takes a vacation, skimmers, remain a way they try to gain access to your information. Below are some things to keep in mind when using your card at an ATM or gas pump.

Stay alert and check for the following, before using your card:

- If at a gas pump or an ATM, ask yourself if the unit looks like it was tampered with. Many gas stations now put security seals over the cabinet panel. If the pump panel is opened, the label will read "void."

- Look at the card reader itself. Does it look different than other readers that you’ve seen in the past?

- Don’t be shy. Try to wiggle the card reader before you put in your card. If it moves, report it and do not use that terminal.

- If you use a debit card at the pump, run it as a credit card instead of entering a PIN. That way, the PIN is safe and the money isn’t deducted immediately from your account.

- Tap your card instead of swiping or inserting it when paying at a pump if the terminal allows for it. Tap-to-pay transactions are more secure and less likely to be compromised.

- Consider paying inside.

- Monitor your credit card and bank accounts regularly to spot unauthorized charges.

If you feel you may be a victim, log in to your account and lock your card using the card controls within digital banking and report it by sending us a secure message from within digital banking or by connecting with our Contact Center at 800.562.6049 or stopping in any Service 1st location.

The Federal Trade Commission and the Federal Bureau of Investigations (FBI) are great resources to help you stay up to date regarding scams.

Your trust is of utmost importance to us, and we are committed to keeping your accounts secure.

Please watch your email and this page for updates.

Thank you for your understanding and continued membership with Service 1st.

Sincerely, Your friends from Service 1st

Additional Resources:

Federal Trade Commission (FTC)

Federal Bureau of Investigations (FBI)

08.12.2024

member notice | debit card review

At Service 1st Federal Credit Union, keeping you informed and keeping your information safe is a top priority.

We recently discovered suspicious activity which could indicate unauthorized access to certain debit card details.

At this time, we are actively investigating the situation, following proper protocol and working closely with security experts to ensure your information remains protected. We take the security of your financial data very seriously, and we are committed to resolving this matter as quickly and thoroughly as possible.

What You Should Do:

1. Monitor Your Account: Please review your account statements and transaction history for any unauthorized transactions. If you notice anything unusual, please report it to us immediately. You can easily report it by:

- logging into your digital banking account and sending us a secure message

- calling our Contact Center at 800.562.6049

- visiting your favorite Service 1st branch location.

2. Place a lock on your card: Keep in mind, if you think you may be a victim of identity theft involving your credit or debit card, you can log in to your account and temporarily block access to your cards. While this will disable them from being used until you re-enable them or a new card is issued to you - it will stop evil doers from using them as well.

3. Consider Card Replacement: For added security, we may recommend that you consider replacing your current debit card. You can request a new card by calling our Contact Center at 800.562.6049 or stopping in your local Service 1st office.

4. Always stay alert: Unfortunately, evil doers will stop at nothing to try to gain access to your account information, click here to view a recent article we shared that includes links to the Federal Trade Commission (FTC). The FTC shares updated information related to scams and what to do if you are a victim.

We apologize for any inconvenience this item may cause and appreciate your patience as we complete a full review of this matter. Your trust is of utmost importance to us, and we are committed to keeping your accounts secure.

Please watch your email and this page for updates.

Thank you for your understanding and continued membership with Service 1st.

Sincerely,

Your friends at Service 1st

*Contact credit union for full details.